accumulated earnings tax form

The tax code imposes this penalty tax on C corporations with large accumulations of cash based upon the theory that companies holding. Your tax advisor knows your financial situation and can best assist you in choosing how to receive your benefit and minimize the tax you pay on this income.

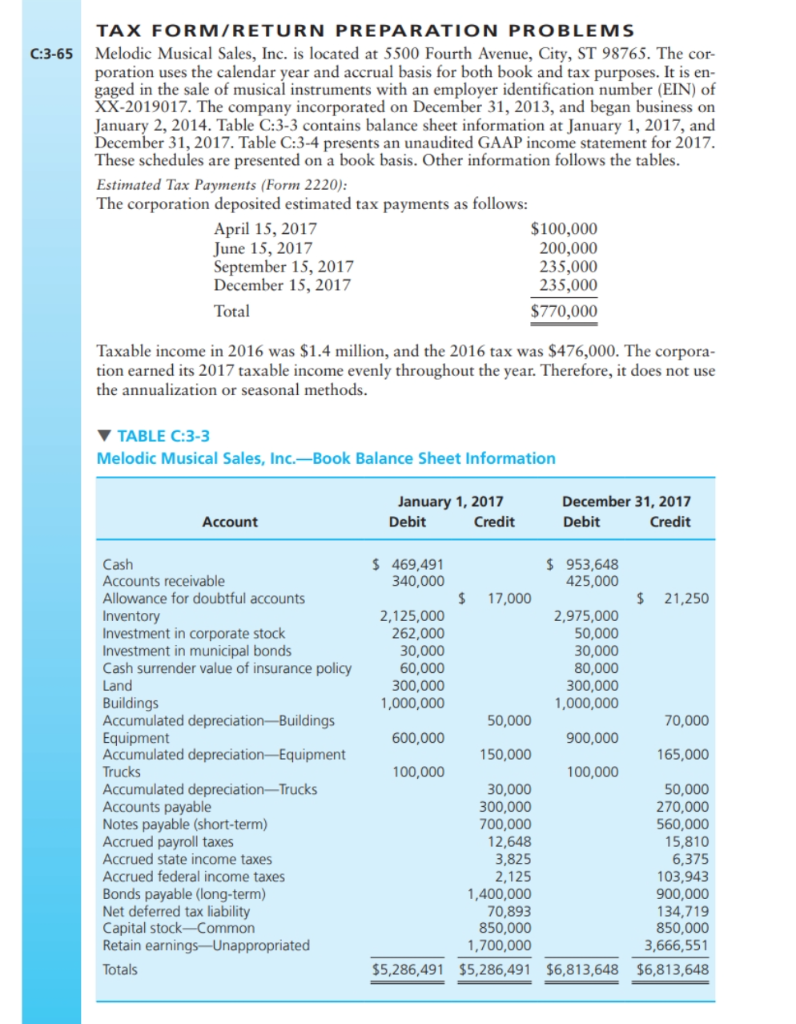

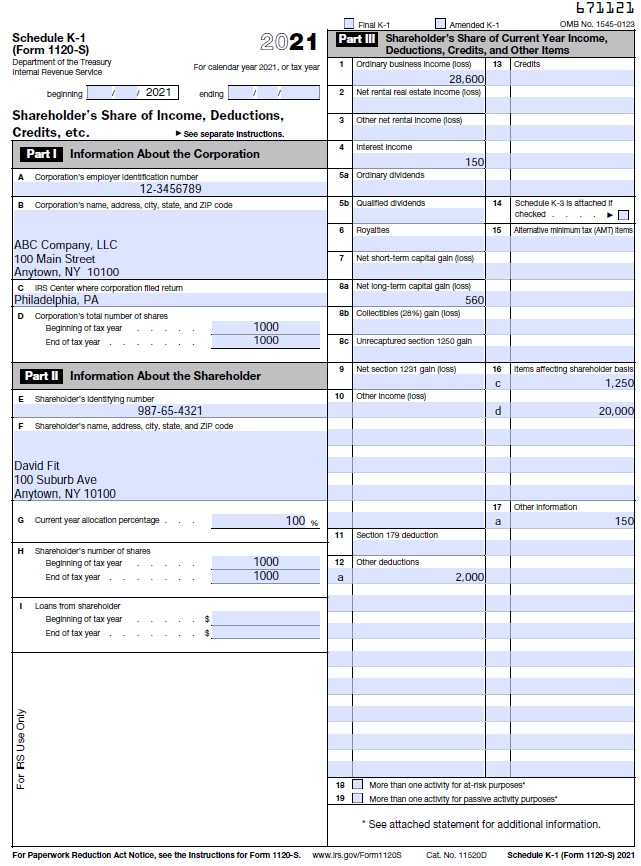

How To Complete Form 1120s Schedule K 1 With Sample

Guaranteed maximum tax refund.

. Shareholders information to complete an amount in column e see. Free means free and IRS e-file is included. New Jersey CountyMunicipality Codes Enter the Appropriate Four-Digit Number on Line 5 Vendor Data ATLANTIC COUNTY 0304-Bordentown Twp.

The accumulated earnings tax is a penalty tax. However if a corporation allows earnings to accumulate. Every domestic corporation branch of a foreign corporation.

Purpose of Form IT-221 Use Form IT-221 to determine any amount of disability income that could have been excluded from federal adjusted gross income based on Internal Revenue Code IRC. Max refund is guaranteed and 100 accurate. Closely held corporations b.

Ad Free tax filing for simple and complex returns. Part I Accumulated EP of Controlled Foreign Corporation. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys.

Check the box if person filing return does not have all US. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

Accumulated Earnings Tax Form will sometimes glitch and take you a long time to try different solutions. These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report. LoginAsk is here to help you access Accumulated Earnings Tax Form quickly and.

_____ FOR NEW JERSEY. Tax-exempt organizations Publicly held corporations assume it fails the stock ownership test. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary.

Improperly Accumulated Earnings Tax IAET Return.

Schedule I Summary Of Shareholder Income Irs Form 5471 Youtube

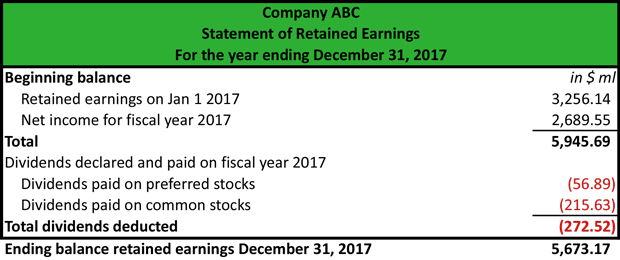

How Is Retained Earnings Calculated On Form 1120

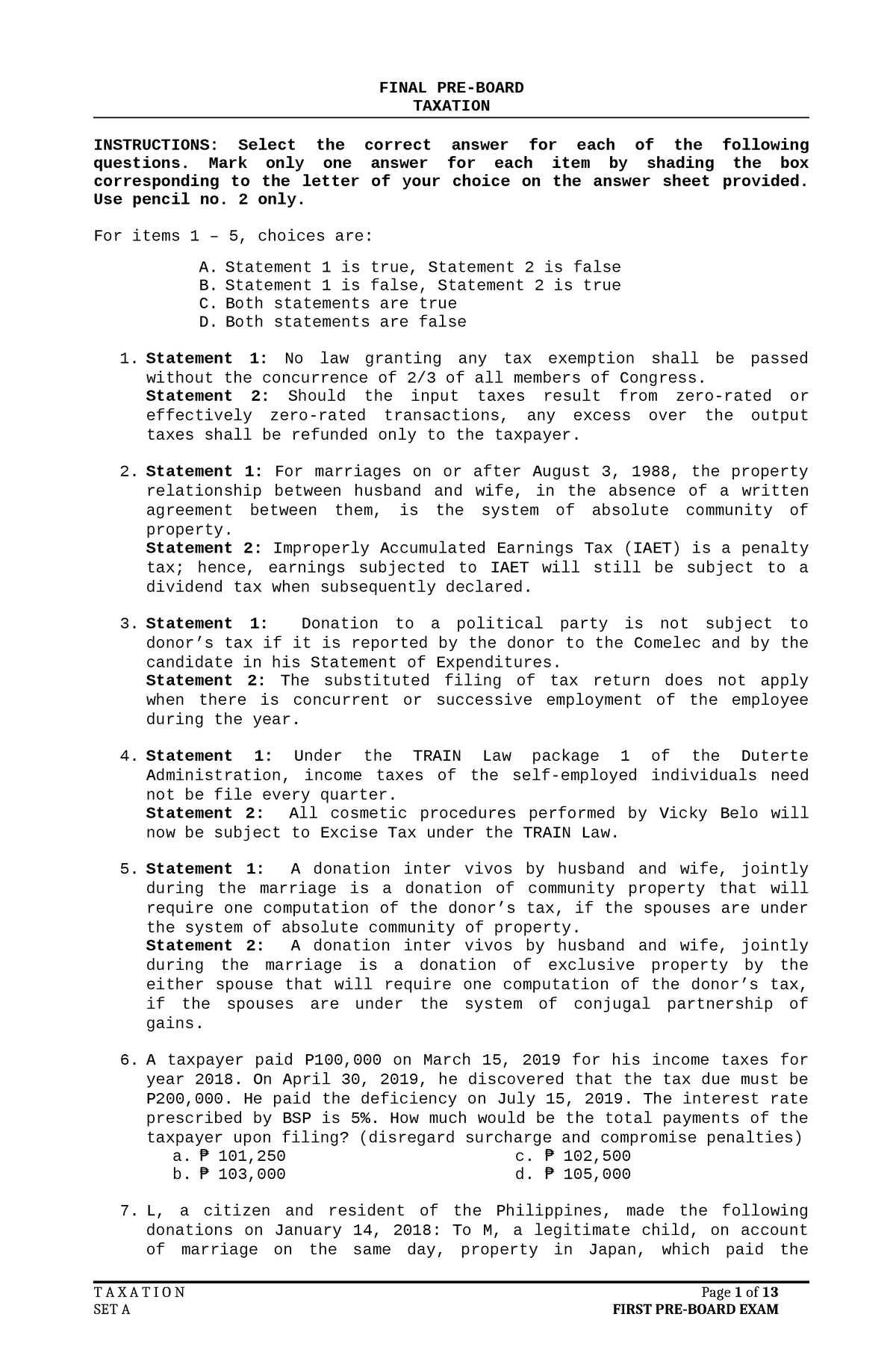

Oct 2018 Final Preboard No Answer File File File File Final Pre Board Taxation Instructions Studocu

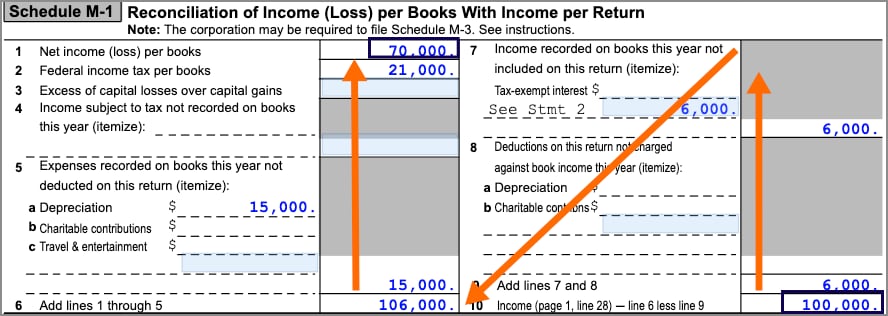

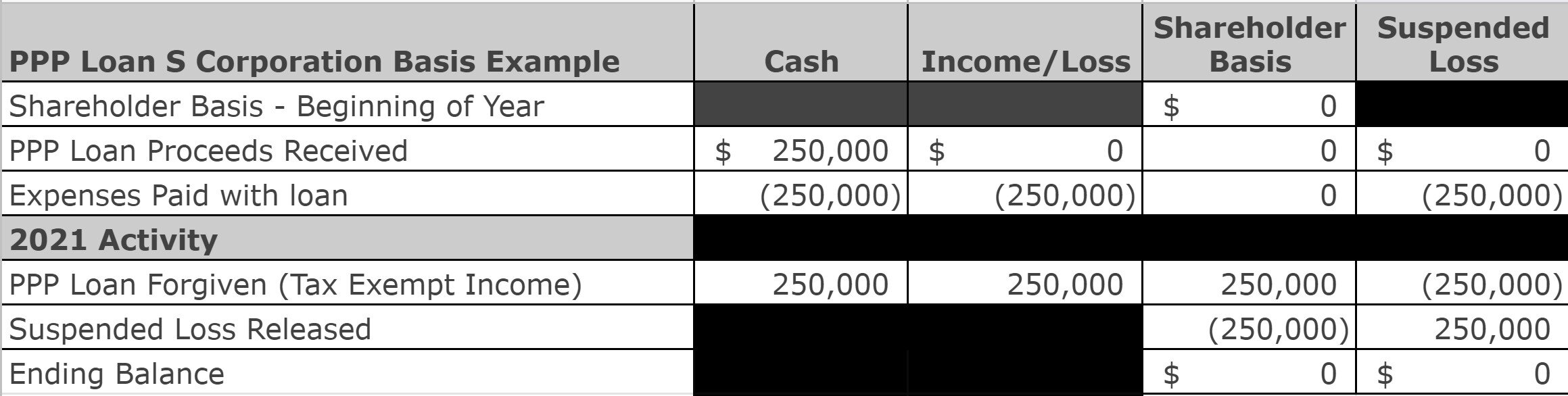

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

Irs Use Of Accumulated Earnings Tax May Increase

Double Taxation Of Corporate Income In The United States And The Oecd

Instructions For Filing Form 1120 S Us Income Tax Return For An S Corporation Lendstart

Determining The Taxability Of S Corporation Distributions Part Ii

Please Complete The Schedule D Form At The Bottom Chegg Com

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

Determining The Taxability Of S Corporation Distributions Part Ii

How To Complete Form 1120s Schedule K 1 With Sample

How To File S Corp Taxes Maximize Deductions White Coat Investor

Unappropriated Retained Earnings Meaning How Does It Work

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Darkside Of C Corporation Manay Cpa Tax And Accounting